Twists and Turns in the Year of the Snake

Introductory remarks

Good afternoon, everyone!

It’s good to see many friendly faces. Though I sometimes see that as a mixed blessing. As Luke said in 4:24 , one cannot be a prophet in one’s own land.

I thought to title my talk “Twists and turns in the year of the snake”. The snake seemed a particularly apt Chinese astrological animal at this time of unprecedented uncertainty, where one can be unsuspectingly bitten, or to mix metaphors, be tempted by forbidden fruit with tragic consequences. (Though as someone reminded me, if Adam and Eve were Chinese, they would have eaten the snake instead! )

For those who have been entertained by my briefings as an economic political analyst, I apologize in advance for my greater reserve. It’s not because I am no longer entitled to publicly air my private views— though that’s a consideration. It’s more that being in government teaches one humility. I quote what Henry Kissinger famously said: the longer I am away from government, the more infallible I become. Or an older one from Galsworthy in the 18th century: The degree of idealism is directly proportional to the distance from the problem.

_________

The Year of the Snake is off to an interesting start. Global markets are grappling with the possible repercussions of the ongoing geopolitical fragmentation. Much has already unfolded in the early goings of 2025, and there are bound to be more twists and turns in the the months ahead. Luckily for us, the Philippine economy remains resilient amid emerging risk on both domestic and global fronts.

My talk will be in several parts. First, I will set the stage, the Philippine economy since the pandemic focusing on inflation and growth. Then zoom in on financial and monetary conditions and actions we have taken to make it more resilient. Finally, I will try to crystal ball the uncertainties that face us this year and beyond: Trump 2.0, potential AI disruption, domestic politics.

Setting the stage: the Philippine economy since the pandemic

I. INFLATION DEVELOPMENTS

The BSP remains committed to its primary focus on

inflation. We have made significant progress in this

area, with headline inflation decreasing from a peak of 8.7 percent in January 2023. Measures of underlying inflation have also declined. Furthermore, inflation expectations remain within the target range.

It is tempting to declare victory over inflation, given how our projections continue to indicate within-target inflation through 2026 Nonetheless, we remain cautious.

During the policy meeting this February, estimates indicate aslight uptick in the baseline inflation forecasts. Our baseline forecast for average inflation is now 3.5 percent for both 2025 and 2026.

Incorporating risk factors, inflation could be steady for 2025 but could increase to 3.7 percent for 2026. This is important since monetary policy works with a lag and could mostly affect inflation in 2026.

We will continue to monitor the upside risks that may emanate from higher utility charges.

II. ECONOMIC DEVELOPMENTS

Turning to growth. The broader picture shows that the Philippine economy has emerged from the pandemic and the recent inflation episode in a relatively favorable position. The Development Budget Coordination Committee (DBCC) (where the BSP is a resource institution) sees growth reaching 6-8% in 2025-2026.

I referenced the pandemic primarily as a point of comparison. For context, at the start of the pandemic in 2020, I was the Philippine advisor for GlobalSource, an international network of country analysts providing on-the- ground macroeconomic and political risk assessments. Our outlook then was for GDP to contract by around 7 percent for the full year. Others were saying the economy could contract by around 10 to 15 percent. The actual outturn, as we know, was negative 9.5 percent.Looking back, the country's fundamental strengths provided the government the flexibility it needed to respond to the pandemic, allowing the economy to avoid a direr outcome.

In the post-inflation episode, one of the most salient narratives on growth is that the economy will likely continue to grow at a moderate pace through 2026. Part of the story is due to subdued investments, which was an expected effect that followed a record tightening of monetary policy. As you know, the transmission of monetary policy has long lags [12 to 15 months] so the BSP’s recent shift to an easing cycle has yet to fully support a meaningful increase in investment.

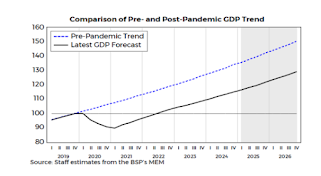

The pandemic has also left a mark on the economy. The country’s annualized real GDP has already recovered above its pre-pandemic level in Q3 2022, However, it remains below its pre-pandemic trend level reflecting the long term scarring effects of the pandemic. Prior to the pandemic, from 2009 to 2019, the country’s GDP was growing robustly at an average of 6.0 percent. Our latest forecasts suggest that the projected level of GDP through to the fourth quarter of 2026 will likely remain significantly lower compared to its pre-pandemic trend.

Meanwhile, potential output growth also decelerated as consumer spending slowed last quarter and as manufacturing growth remained sluggish amid subdued global demand due to political tensions and the slow recovery of advanced economies. This, however, was partly tempered by the improvements in labor market conditions as unemployment and underemployment numbers continued to drop during the quarter.

Labor productivity has yet to bounce back to pre- pandemic average levels. Between 2012-2019, the country’s labor productivity grew by an average of about 5.0 percent. However, from 2021-2024, following the pandemic, it has grown by an average of only 0.7 percent. This is despite the continued drop in unemployment and underemployment

Comparison of Labor Productivity and Ave. Real Minimum Wage Growth for Pre- and Post-Pandemic Periods

The government has laid out plans to spur economic growth by, among other things, accelerating infrastructure investments(at 5 to 6 percent of GDP annually), enhancing the ease of doing business, and boosting national competitiveness. The “Build Better More” infrastructure program likewise boosts partnership with private sector stakeholders for key infrastructure projects. The government will also invest heavily on human capital and in projects that align the Philippine workforce with the fast-evolving, tech-driven job market.

The country’s fiscal position remains resilient.Outstanding government debt jumped by 20 percent post-pandemic (from end-2022), resulting in a debt-to-GDP ratio of about 60.7 percent (as of December 2024). This highlights the importance of the fiscal consolidation being pursued by the national government over the medium term, to ensure that debt levels are sustainable.

The S&P Global seemed to have recognized this position of strength when it raised the country’s sovereign rating from stable to positive in November. Our fiscal authorities will need to ensure steady progress in critical fiscal policy reforms, the plugging of revenue leakages, and improvements in the absorptive capacity of implementing agencies.

As for the potential impact of recent global developments, I believe the Philippine economy has more than enough buffers. Our international reserves (GIR) continue to be a reliable backstop against external shocks. As of end-January 2025, our reserves are equivalent to 7.3 months’ worth of imports of goods and payments of services and primary income; and about 3.6 times the country’s short-term external debt based on residual maturity. Although the current account deficit is expected to widen moderately this year against a backdrop of improving investment and infrastructure spending, it remains financeable, as we continue to see steady structural inflows of foreign exchange via overseas Filipinos' (OF) remittances, business process outsourcing (BPO) revenues, tourist receipts, and strong foreign direct investment (FDI) inflows.

My main worry is related to our export earnings. A narrow goods export base consisting mainly of electronics makes that sector overly sensitive to changes in global electronics demand. Electronics, which comprised about half (49.8 percent) of Philippine exports in 2024, faces a slowdown due to the global inventory correction in the semiconductor industry and a less-competitive product mix that is concentrated largely on legacy products and lower-end components. As global demand shifts towards new electronics for energy transition and artificial intelligence (AI), Philippine semiconductor exports are less aligned with high-demand products.

Turning to another growth area, the BPO sector is being disrupted by the emergence of generative AI,(adding another layer of complexity on top of Trump's protectionist bent). BPO industry insiders seem confident that the Philippines can adapt, move up the value chain and maintain growth at around 6 percent. But at the same time, they admit of skills shortage that could constrain expansion over the medium term. Apart from rising operational costs (e.g., rent, wages, training costs), increasing global competition from other outsourcing countries (such as Malaysia, Poland, and Africa) could also be a headwind to the industry’s high growth trajectory. Nonetheless, growth in the IT-BPM industry will be supported by further AI integration. Moreover, increasing demand for healthcare information management also positions the country as a global leader in healthcare outsourcing.

III. FINANCIAL AND MONETARY CONDITIONS

During the period of tightening of policy rates, the banking sector has maintained solid performance. This is demonstrated by a continued uptrend in assets, loans, deposits, and earnings, along with reasonable provisions for non-performing loans (NPL). As concerns over inflation abate, the BSP has gradually shifted to a less restrictive stance. Our latest data, as of December 2024, indicates thatthe “pass-through” of the BSP’s cumulative 75-bp reduction in policy rates in 2024 has been generally stronger for short-term bank lending rates and moderate for medium- to long-term lending rates.

In our view, monetary policy transmission will be made more efficient with a shorter lag time on this pass- throughby improving depth and liquidity in the local capital market, starting with the money market.

To this end,capital market development is a crucial priority in the BSP’s medium-term strategic plans. A key objective is to develop alternative sources of funding to corporates, and even to smaller businesses that may lack collateral. If there are alternative funding sources, then thecredit risk largely carried by the banking sector will be diversified,ultimately enhancingfinancial stability. A deep capital market can also fund businesses with higher risk profiles that the banking sector might not traditionally serve. In this way, capital markets can also boost innovation.

This is where improving the benchmark yield curve plays a crucial part in strengthening overall price discovery primarily in the money market and in other segments. As you know, on 18 November 2024, the Bankers Association of the Philippines (BAP) launched an enhanced Peso interest rate swap (IRS) product based on the BSP’s variable overnight reverse repurchase rate. A revitalized PHP IRS market is expected to support thecreationof an interest rate “swap curve” that could serve as a reference benchmark for pricing corporate bonds, mortgages, and bank loans.

The BSP is also working with the BAP to expand the GS repo market. The goal is to transform transactions in the BSP’s RRP and OLF facilities into “real” repos, with the adoption of the Global Master Repurchase Agreement (GMRA) and the actual delivery of collateral government securities. By enabling the transfer of legal ownership of securities as collateral, banks can use the securities for trading with each other or to meet regulatory requirements. This, in turn, could support pricing and facilitate more trading of securities in the secondary market. In addition to deepening liquidity and facilitating bond price discovery, this will help develop hedging tools for better risk management and attract local and foreign investors to the Philippine government securities market by reducing credit risks and financing costs.

Future adjustments in the reserve requirement ratios (RRRs) will also ultimately enhance monetary policy transmission. As we gradually dial back monetary policy restriction, we see that further reductions in the RRR will appropriately support our continuing shift towards more market-based monetary operations.

We also want to minimize financial system distortions in the form of high intermediation costs and transaction fees, so that banks can more efficiently channel their funds towards productive loans and investments. To this end, bringing the Philippines’ reserve requirement ratio (RRR) in line with its peers in the region continues to be a long-run goal.

[AMLA Greylist] In 2021, the Philippines made a high-level political commitment to work with the Financial Action Task Force (FATF) to strengthen the effectiveness of its anti- money laundering and combating the financing of terrorism (AML/CFT) regime. At its October 2024 plenary, the FATF initially determined that the Philippines has substantially completed its action plan, warranting an on- site assessment to verify that the implementation of AML/CFT reforms has begun and is being sustained.

The Philippines has addressed the 18 action plan items that have kept the country in the greylist. The FATF’s Asia/Pacific Joint Group (APJG) visited the Philippines in January to confirm this assessment and verify the sustainability of the AML/CTF reforms. The removal of the Philippines from the greylist could potentially improve the credit rating and expand foreign investments.

IV. DEALING WITH UNCERTAINTY (Impact of Trump policies on the Philippine Economy and other domestic concerns)

Policymakers must navigate uncertainty, remaining nimble to evolving economic conditions. The landscape of external risks arising from policy uncertainty, particularly from Trump 2.0, calls for increased vigilance against potential supply shocks and a global growth slowdown. If these early weeks of the year are any indication, we may need to brace ourselves for more twists and turns this 2025. Perhaps the big question on everyone’s minds at the moment is just how far this looming trade war could go and how much of a blow this could be to the global economy.

To recall,during the first Trump administration (2017- 2020),the US-China trade conflict led to tariffs on over US$500 billion worth of goods in both economies. Between September 2018 and December 2019, —before the Phase One deal was announced—ASEAN+3 exports contracted significantly after previously growing at an average rate of 10 percent.

The Philippines was largely insulated from these trade tensions due to its low participation in global trade and value chains. Despite close trade ties with the US, the Philippines also did not benefit much from the US-China tariffs, unlike Vietnam and Mexico.

In 2023, the Philippines’ trade surplus with the US was at US$3.1 billion (equivalent to 0.7 percent of GDP), and US$3.2 billion in the first ten months of 2024. This small surplus makes it less likely to face targeted US tariff.

However, the anticipated higher tariffs in other countries, particularly China, could impact Philippine trade, by fragmenting global supply chains. This highlights the need for the Philippines to strengthen trade relations with the US through a bilateral Free Trade Agreement (FTA) and other sectoral agreements.

The country’s IT-BPM industry, with 70 percent of its market in North America (predominantly the US), faces challenges under a potential Trump 2.0 administration. There is reason to be concerned: during Trump’s previous term, growth in Philippine BPO earningsslowedsharply to 2.5 percent in 2017 and 3.9 percent in 2018, from 12.3 percent in 2016. US firms offshore have also indicated their plans to move operations closer to the US, either through reshoring or relocating to politically stable or geographically convenient countries.

Nevertheless, the possible decline in US outsourcing demand may be partially offset by the industry’s expansion in Europe and Asia Pacific, each of which accounts for about 15 percent of the country’s total IT-BPM market as of 2023.

On the local front, we only need to open the front pages of the newspapers to appreciate the looming risks that may impact the economy not just this year but beyond. Though 2025 is only on senatorial and local elections, it is shaping up to be an existential contest among the protagonists, with profound consequences on our country’s medium term domestic and foreign policy (including on super power conflict) and our future.

V. CLOSING STATEMENT: PATH FOR MONETARY POLICY

I will conclude by explaining the rationale for our recent decision. While the latest forecasts point to within-target inflation, evolving risks to the outlook for inflation and growth as well as elevated policy uncertainty over the external environment warranted a pause in monetary policy easing at this juncture.

The BSP continues to be attentive to the risks to our inflation outlook, and we continue to support the government’s direct initiatives to address supply constraints and improve agricultural productivity to help mitigate price pressures over the long run.

To reiterate, the BSP will maintain its measured approach to monetary policy easing settings, as it continues to observe the impact of prior monetary policy adjustments on the economy). The BSP will remain data-dependent in deciding on the pace and timing of further reductions in the policy rate. With all these challenges on the horizon, the BSP is geared towards ensuring that the country remains resilient across a wide front. As always, the BSP’s policies and initiatives are centered on delivering on its mandates.

In closing, while the Philippine economy continues to face many challenges, its fundamental strength and resilience remain clear. We are on the brink of new opportunities,and the BSP, along with the country’s economic managers, will continue to push for the progress that we want to achieve.

The good news? The last mile of our battle against inflation has turned in our favor. But it remains to be seen how the current geoeconomic shifts will impact us. Whether it leads to the best or worst of times, no one knows at this point. If Dickens were around today, he might sum it up like this:

"It was the best of times, the worst of times; a season of innovation and disillusionment; an age of connection, yet division; a moment of climate urgency, trumped by escalating chaos; AI at our fingertips, but truth fading; unity promised, but discord reigning; progress made, hope sought, but uncertainty looms.”

And this, as we know, is the landscape of risk and opportunities that the market will navigate in the year ahead.

Maraming salamat po!